As the fine print mortgage bill answer key takes center stage, this opening passage beckons readers into a world crafted with authority and knowledge, ensuring a reading experience that is both absorbing and distinctly original. Within the intricate tapestry of mortgage agreements, the fine print often holds hidden truths and potential pitfalls.

This comprehensive guide unravels the complexities of mortgage bills, empowering homeowners with the understanding they need to make informed decisions and protect their financial well-being.

Unveiling the significance of carefully scrutinizing mortgage fine print, we embark on a journey through the key terms and clauses that shape the repayment landscape. From prepayment penalties to late fees and balloon payments, this guide illuminates the potential consequences of overlooking critical details.

By arming readers with the knowledge to identify hidden costs and negotiate favorable terms, we empower them to navigate the mortgage maze with confidence.

Mortgage Fine Print: Fine Print Mortgage Bill Answer Key

Mortgage fine print contains essential details about the terms and conditions of your loan. Carefully reviewing it helps you understand your rights and responsibilities as a borrower and ensures you make informed decisions.

Key terms and clauses to pay attention to include:

- Loan amount:The total amount you are borrowing.

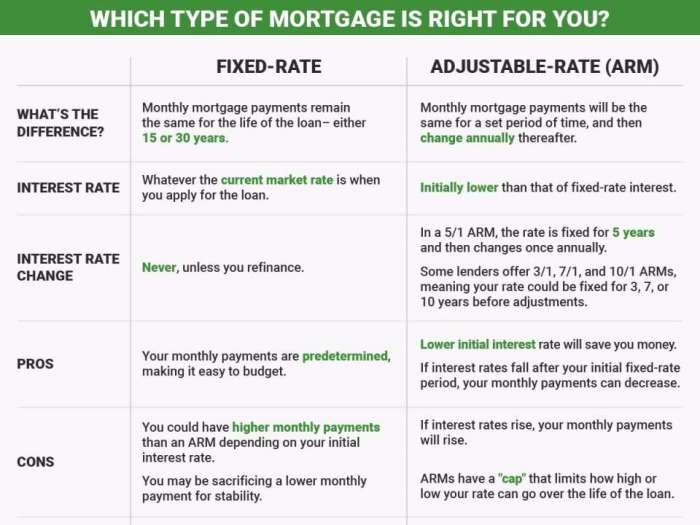

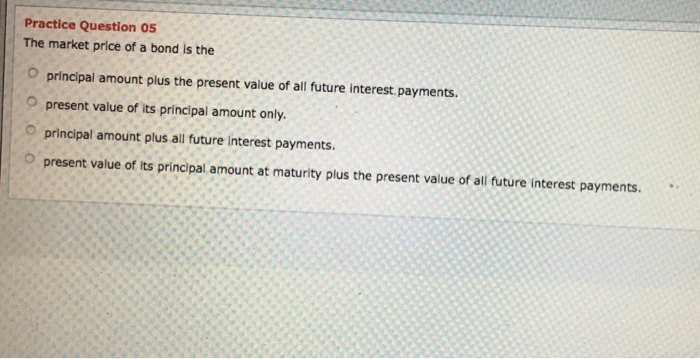

- Interest rate:The percentage of the loan amount you will pay in interest over the loan term.

- Loan term:The length of time you have to repay the loan.

- Monthly payment:The amount you will pay each month towards the loan.

- Prepayment penalty:A fee you may have to pay if you pay off the loan early.

- Escrow account:An account where you deposit money to pay for property taxes and insurance.

Overlooking important details in the fine print can have serious consequences. For example, you could end up paying more interest than you expected or facing penalties for prepaying the loan. It is crucial to read and understand the fine print before signing a mortgage agreement.

Understanding Mortgage Bill Structure

A mortgage bill, also known as a mortgage statement, is a detailed document that Artikels the status of your mortgage loan. It provides information about the amount you owe, the interest and principal payments made, and any additional fees or charges.

Understanding the structure of your mortgage bill is crucial for managing your finances effectively.

Typically, a mortgage bill is divided into several sections, each providing specific information about your loan. The following table summarizes the common sections and the information they contain:

Sections of a Mortgage Bill

| Section | Information |

|---|---|

| Payment Due Date | The date by which your payment is due to avoid late fees. |

| Payment Amount | The total amount due for the current billing cycle, including principal, interest, and any additional fees. |

| Interest | The portion of your payment that goes towards paying the interest on your loan. |

| Principal | The portion of your payment that goes towards reducing the outstanding balance of your loan. |

| Additional Fees | Any additional charges or fees, such as late fees, property taxes, or homeowners insurance premiums, that are included in the total payment amount. |

Understanding each section of your mortgage bill is essential for staying informed about the status of your loan. By carefully reviewing your mortgage bill each month, you can ensure that your payments are being applied correctly and that you are on track to pay off your mortgage on time.

Identifying Hidden Costs

Mortgage bills often contain hidden costs that can significantly increase the overall cost of the loan. These costs are often buried within the fine print and can be easily overlooked by borrowers. It is important to be aware of these hidden costs before signing a mortgage agreement.

Prepayment Penalties, Fine print mortgage bill answer key

Prepayment penalties are fees charged to borrowers who pay off their mortgage early. These penalties can be a significant deterrent to refinancing or selling a home before the end of the loan term. The amount of the prepayment penalty varies depending on the lender and the type of mortgage.

Some lenders charge a flat fee, while others charge a percentage of the remaining loan balance.

Late Fees

Late fees are charged to borrowers who fail to make their mortgage payments on time. These fees can add up quickly, especially if the borrower is consistently late with their payments. The amount of the late fee varies depending on the lender and the type of mortgage.

Some lenders charge a flat fee, while others charge a percentage of the monthly payment.

Balloon Payments

Balloon payments are large, lump-sum payments that are due at the end of the loan term. These payments can be a significant financial burden for borrowers who are not prepared for them. Balloon payments are often used in adjustable-rate mortgages (ARMs).

When the interest rate on an ARM increases, the monthly payments will also increase. This can make it difficult for borrowers to afford their mortgage payments, especially if they are already struggling to make ends meet.

Negotiating Mortgage Terms

Negotiating mortgage terms can be an effective way to secure a better deal on your home loan. By understanding the process and following a few key steps, you can increase your chances of getting the best possible terms for your financial situation.

The first step in negotiating mortgage terms is to do your research. This means getting pre-approved for a mortgage, understanding your credit score, and shopping around for the best interest rates and fees. Once you have a good understanding of your financial situation and the mortgage market, you can start the negotiation process.

Step-by-Step Process for Approaching Negotiations

- Be prepared.Before you start negotiating, it’s important to have a clear understanding of your financial situation and what you’re looking for in a mortgage. This includes knowing your credit score, your debt-to-income ratio, and the amount of money you can afford to borrow.

- Start with a strong offer.When you make an offer on a home, it’s important to start with a strong offer that is close to the asking price. This will show the seller that you’re serious about buying the home and that you’re willing to negotiate.

- Be willing to walk away.If the seller is not willing to negotiate, be prepared to walk away. There are plenty of other homes on the market, and you don’t want to overpay for a home that you’re not happy with.

By following these tips, you can increase your chances of getting the best possible deal on your mortgage.

Protecting Against Predatory Lending

Predatory lending practices are characterized by unfair or deceptive tactics that take advantage of borrowers who may be vulnerable or financially distressed. These practices can include high interest rates, excessive fees, and balloon payments that make it difficult for borrowers to repay their loans.

Warning Signs of Predatory Lending

- High interest rates:Interest rates that are significantly higher than the prevailing market rates may be a sign of predatory lending.

- Excessive fees:Lenders who charge excessive fees, such as origination fees, closing costs, and prepayment penalties, may be trying to take advantage of borrowers.

- Balloon payments:Balloon payments are large lump-sum payments that are due at the end of the loan term. These payments can make it difficult for borrowers to repay their loans and may result in foreclosure.

- Prepayment penalties:Prepayment penalties are fees that are charged to borrowers who pay off their loans early. These penalties can make it difficult for borrowers to refinance their loans or sell their homes.

- Lack of transparency:Lenders who do not provide clear and concise information about the terms of their loans may be trying to hide predatory practices.

How to Avoid Predatory Lending

- Shop around for a loan:Compare loan offers from multiple lenders to find the best interest rate and terms.

- Read the loan agreement carefully:Make sure you understand all of the terms of the loan before you sign it.

- Get help from a housing counselor:Housing counselors can provide free or low-cost advice on how to avoid predatory lending.

- Report predatory lenders:If you believe you have been the victim of predatory lending, you can report the lender to the Consumer Financial Protection Bureau (CFPB).

Seeking Professional Advice

Consulting with a mortgage expert or attorney can be highly beneficial when navigating the complexities of mortgage fine print. These professionals possess specialized knowledge and expertise that can help you understand the terms and conditions of your loan, ensuring your interests are protected.

Role of Professionals

Mortgage experts and attorneys can play a crucial role in:

- Explaining the intricate language and clauses found in mortgage documents.

- Identifying potential hidden costs and fees that may not be immediately apparent.

- Negotiating favorable terms and conditions on your behalf.

- Advising you on your legal rights and responsibilities as a borrower.

- Protecting you against predatory lending practices.

Finding a Reputable Professional

Finding a reputable mortgage expert or attorney is essential. Consider the following tips:

- Obtain referrals from trusted sources such as financial advisors or real estate agents.

- Research potential professionals online, checking their credentials and experience.

- Interview several candidates to assess their knowledge, communication skills, and willingness to advocate for your interests.

- Verify their license and insurance status to ensure they are qualified and reputable.

FAQ Section

What is the significance of reviewing the fine print in a mortgage bill?

The fine print in a mortgage bill contains crucial information that can significantly impact your repayment obligations. It Artikels key terms, clauses, and potential hidden costs that may not be readily apparent upon a cursory review.

What are some examples of key terms and clauses to pay attention to in mortgage fine print?

Important terms and clauses to watch out for include prepayment penalties, late fees, balloon payments, adjustable interest rates, and any other provisions that may affect your monthly payments or the overall cost of your mortgage.

What are some potential consequences of overlooking important details in the fine print of a mortgage bill?

Overlooking important details in mortgage fine print can lead to unexpected expenses, higher interest charges, and even foreclosure. It is essential to carefully review and understand all aspects of your mortgage agreement to avoid any adverse consequences.