A manufacturer’s raw materials inventory account appears as follows, setting the stage for an exploration into the intricacies of inventory management, valuation methods, and financial implications. This comprehensive guide delves into the heart of manufacturing operations, unraveling the significance of raw materials inventory and its impact on a company’s financial health.

The account structure and content lay the foundation for understanding the components of raw materials inventory, while valuation methods provide a framework for determining its value. Inventory management techniques shed light on strategies employed to optimize inventory levels, and the impact on financial statements highlights the crucial role of inventory in financial reporting.

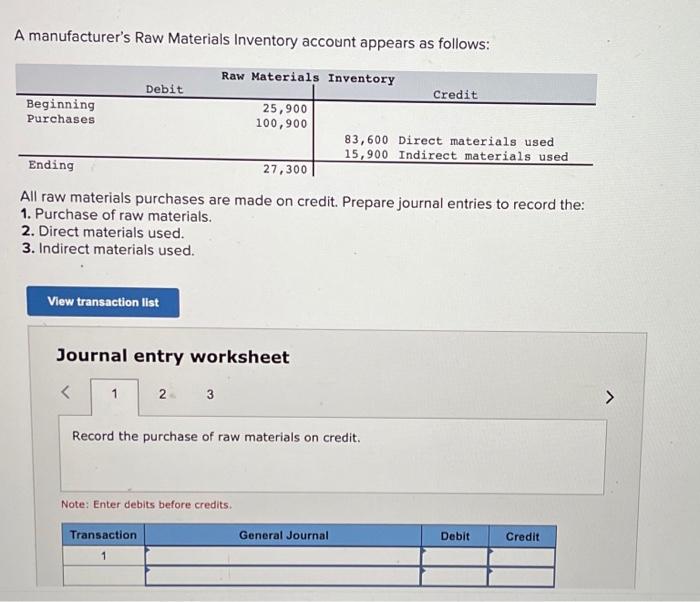

Manufacturer’s Raw Materials Inventory Account

A manufacturer’s raw materials inventory account tracks the raw materials used in the production process. It is an important account for manufacturers as it provides information about the quantity and value of raw materials on hand, which is crucial for production planning and cost control.

Account Structure and Content

The raw materials inventory account is typically structured as follows:

- Beginning balance: The value of raw materials on hand at the beginning of the period.

- Purchases: The cost of raw materials purchased during the period.

- Transportation costs: The cost of transporting raw materials to the manufacturing facility.

- Storage expenses: The cost of storing raw materials.

- Ending balance: The value of raw materials on hand at the end of the period.

Valuation Methods

Different methods can be used to value raw materials inventory, including:

- FIFO (First-In, First-Out): Assumes that the oldest raw materials are used first.

- LIFO (Last-In, First-Out): Assumes that the newest raw materials are used first.

- Weighted average cost: Calculates the average cost of all raw materials on hand.

Inventory Management Techniques

Manufacturers use various inventory management techniques to optimize raw materials inventory levels, such as:

- Just-in-time inventory: Aims to minimize inventory levels by receiving raw materials only when needed for production.

- Safety stock: Maintains a buffer stock of raw materials to prevent production disruptions due to unexpected demand or supply shortages.

- Inventory forecasting: Predicts future raw materials demand based on historical data and market trends.

Impact on Financial Statements

Raw materials inventory affects a manufacturer’s financial statements as follows:

- Balance sheet: Raw materials inventory is reported as a current asset.

- Income statement: The cost of goods sold includes the cost of raw materials used in production.

Accounting for Inventory Transactions

| Transaction | Debit | Credit |

|---|---|---|

| Purchase of raw materials | Raw materials inventory | Accounts payable |

| Usage of raw materials | Cost of goods sold | Raw materials inventory |

| Adjustment for inventory shrinkage | Loss on inventory shrinkage | Raw materials inventory |

Internal Controls and Audit Considerations

Internal controls should be in place to safeguard raw materials inventory, including:

- Physical inventory counts

- Cycle counting

- Inventory management software

Audit procedures commonly performed to verify the accuracy of raw materials inventory records include:

- Observing physical inventory counts

- Reconciling inventory records to purchase orders and receiving reports

- Testing inventory valuation methods

Case Study, A manufacturer’s raw materials inventory account appears as follows

XYZ Manufacturing uses the FIFO method to value its raw materials inventory. The company maintains a safety stock of 10% of its average monthly usage. In 2023, XYZ experienced a sudden increase in demand for its products. The company was able to meet the increased demand without disrupting production due to its well-managed raw materials inventory.

Answers to Common Questions: A Manufacturer’s Raw Materials Inventory Account Appears As Follows

What is the purpose of a manufacturer’s raw materials inventory account?

The raw materials inventory account tracks the quantity and value of raw materials on hand, providing a basis for inventory management and cost accounting.

Why is it important to track raw materials inventory?

Tracking raw materials inventory is crucial for ensuring production continuity, optimizing inventory levels, and maintaining accurate financial records.

What are the common valuation methods used for raw materials inventory?

Common valuation methods include FIFO (first-in, first-out), LIFO (last-in, first-out), and weighted average cost, each with its advantages and disadvantages.

How does raw materials inventory impact financial statements?

Raw materials inventory is a current asset that affects the balance sheet, and its valuation choices influence the cost of goods sold and net income on the income statement.