Some insurance companies can detect fraudulant claims using bi software. – Some insurance companies can detect fraudulent claims using BI software. This technology can help insurers identify and investigate suspicious claims, reducing the risk of fraud and saving money. BI software can be used to analyze large amounts of data, including claims history, policy information, and external data sources, to identify patterns and anomalies that may indicate fraud.

For example, BI software can be used to identify claims that are submitted from the same IP address or device, or claims that are submitted for the same type of loss within a short period of time. BI software can also be used to identify claims that are submitted by individuals or businesses with a history of fraud.

Fraudulent Claims Detection: Some Insurance Companies Can Detect Fraudulant Claims Using Bi Software.

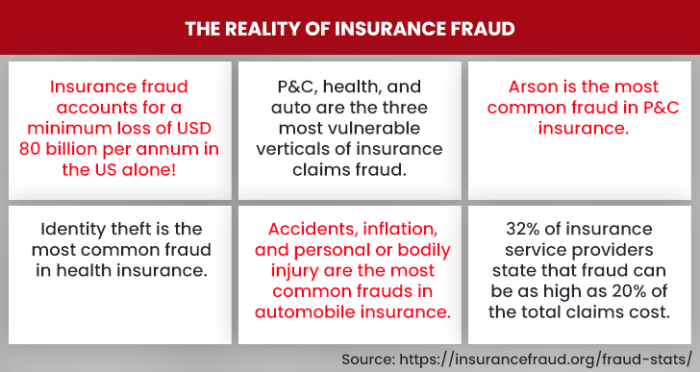

Fraudulent claims are a major problem for insurance companies. They can lead to increased costs, reduced profits, and even financial ruin. BI software can help insurance companies detect fraudulent claims by identifying patterns and anomalies in data. This can help companies to identify claims that are likely to be fraudulent and to investigate them further.

There are a number of different ways that BI software can be used to detect fraudulent claims. One common approach is to use data mining techniques to identify patterns in claims data. These patterns can then be used to create models that can predict the likelihood of a claim being fraudulent.

Another approach to using BI software for fraud detection is to use anomaly detection techniques. These techniques can identify claims that are unusual or unexpected. These claims can then be investigated further to determine if they are fraudulent.

BI software has been used to identify fraud in a number of different insurance industries. For example, BI software has been used to identify fraudulent claims in the health insurance, auto insurance, and workers’ compensation insurance industries.

The benefits of using BI software for fraud detection are numerous. BI software can help insurance companies to:

- Reduce costs

- Increase profits

- Improve customer service

- Protect their reputation

Types of Fraudulent Claims

There are many different types of fraudulent claims. Some of the most common types include:

- Exaggerated claims: These are claims in which the policyholder exaggerates the extent of their injuries or damages.

- Staged claims: These are claims in which the policyholder intentionally causes an accident or injury in order to collect insurance money.

- Fraudulent billing: This is when a healthcare provider bills for services that were not actually provided.

- Identity theft: This is when someone uses another person’s identity to file a fraudulent claim.

BI software can help insurance companies detect each type of fraud. For example, BI software can be used to identify claims that are exaggerated or staged. BI software can also be used to identify fraudulent billing and identity theft.

BI software has been used to detect specific types of fraud in a number of different insurance industries. For example, BI software has been used to identify exaggerated claims in the auto insurance industry. BI software has also been used to identify fraudulent billing in the health insurance industry.

Challenges of Fraudulent Claims Detection

There are a number of challenges associated with detecting fraudulent claims. Some of the most common challenges include:

- The volume of claims: Insurance companies receive a large number of claims each year. This can make it difficult to identify fraudulent claims.

- The complexity of claims: Claims can be complex and difficult to understand. This can make it difficult to identify fraudulent claims.

- The lack of data: Insurance companies often do not have enough data to identify fraudulent claims. This can make it difficult to develop models that can predict the likelihood of a claim being fraudulent.

BI software can help insurance companies overcome these challenges. BI software can be used to automate the process of identifying fraudulent claims. BI software can also be used to analyze large amounts of data and to identify patterns and anomalies that may indicate fraud.

BI software has been used to overcome specific challenges in a number of different insurance industries. For example, BI software has been used to overcome the challenge of the volume of claims in the health insurance industry. BI software has also been used to overcome the challenge of the complexity of claims in the auto insurance industry.

Future of Fraudulent Claims Detection

The future of fraudulent claims detection is bright. BI software is becoming increasingly sophisticated and is able to identify more and more fraudulent claims. In the future, BI software will be able to identify fraudulent claims in real time. This will help insurance companies to prevent fraud and to protect their customers.

BI software is also being used to develop new fraud detection methods. For example, BI software is being used to develop machine learning models that can predict the likelihood of a claim being fraudulent. These models are becoming increasingly accurate and are helping insurance companies to identify fraudulent claims more effectively.

Question & Answer Hub

How does BI software detect fraudulent claims?

BI software can detect fraudulent claims by analyzing large amounts of data, including claims history, policy information, and external data sources, to identify patterns and anomalies that may indicate fraud.

What are the benefits of using BI software for fraud detection?

The benefits of using BI software for fraud detection include reduced risk of fraud, cost savings, and improved efficiency.

What are the challenges of detecting fraudulent claims?

The challenges of detecting fraudulent claims include the increasing sophistication of fraud schemes, the lack of data sharing between insurers, and the need for specialized expertise.